You are a ‘visionary’ woman operating or wanting to operate a business. You are planning both your business and your personal finances. Between your business, and possibly your family, you spend very little time (depending on the maturity of your business) on preparation of your own personal financial goals. You also may be spending so much time operating the business that you aren’t efficiently managing your business financial goals either.

In our experience your younique financial needs include tax preparation, bookkeeping, tax strategies, and spending time translating your business success into your personal financial goals. Eventually, you will need to prepare for moving from business owner to retirement/financial independence.

Between 2007 and 2016, female-owned firms grew five times faster than the national average. As of 2016, there were 11.3 million women-owned firms in the United States that employed nearly 9 million people and generated over $1.6 trillion in revenues. According to the National Association of Women Business Owners and the Small Business Administration, women employ approximately 27 million Americans.

In 2013, women surpassed men in terms of education, with 21% more women than men obtaining an undergraduate degree, and 48% more women attaining a graduate degree than men. And even though women now hold the majority (52 percent) of management, professional and related positions in the U.S., the pay gap is still stark.

Today women have a higher likelihood than men of completing college and graduate school. Unfortunately graduation doesn’t guarantee financial stability. Student loans follow many graduates well into careers, and women face serious obstacles when it comes to debt repayment.

Ten years after graduating, degreed women earned less than degreed men who had been in the workforce only six years. The gender pay disparity was even larger and more immediate among graduates of the most elite universities like Harvard, Stanford and Princeton.

The U.S. Small Business Administration (SBA) recognizes the impact that veterans have on the American economy. According to the most recent data, there is about one veteran-owned firm for every ten veterans, and veteran-owned firms employ 5.8 million individuals. A recent SBA study also found that military service exhibits one of the largest marginal effects on self-employment, and veterans are 45% more likely to be self-employed than non-veterans.

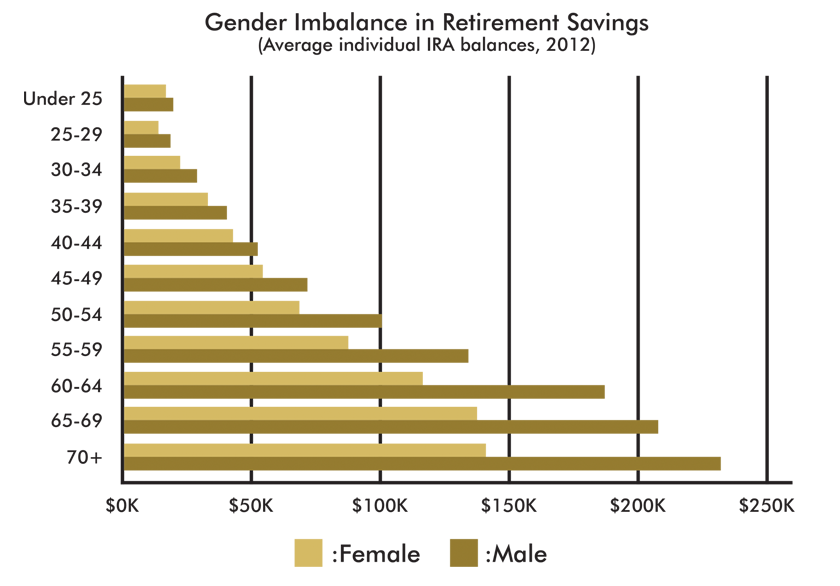

Overall, in 2015, women were the primary breadwinners in over 40 percent of American households, but earned only 78 cents for every dollar a man made. Earning less has a negative effect on families. Additionally, the effect of reduced Social Security benefits accrued put women and families at risk in the future.

The “Do” is what turns the goal into a reality. We would love to work with you to help you understand what you need to do in order to achieve your financial goals. Please Schedule your complimentary assessment.