You are a ‘super’ woman balancing many responsibilities. You may be responsible for your children, your adult parent(s), or both. You are constantly thinking about how to stretch your finances for all your responsibilities and are spending more time worrying about others than you are yourself. Most importantly, you have sole financial responsibility and don’t have the back-up plan of a second income from a partner.

In our experience your younique financial needs include preparing and committing to a spending plan, protecting against job loss (you don’t have a partner as a back-up plan), or building assets to prepare for retirement/financial independence.

More than 41 percent of the female population struggles financially, according to Wider Opportunities for Women, a nonprofit group dedicated to female empowerment. A slowly recovering economy and persistent wage gap makes it imperative for women to increase their financial knowledge.

Nearly half of marriages end in divorce and, in many cases, women encounter financial consequences with higher levels of severity than men. Legal fees, tax liabilities and complications from dividing assets make divorce expensive, and it can take years before financial recovery is possible.

Unlike other financial matters, divorce is hard to plan for. Emotional stress and household tension accompany the financial burden, and the legal process can take months or years to resolve. The majority of women retain custody of children and struggle to make ends meet because of the high cost of childcare. Some women without children also find themselves having to adjust to a lower standard of living following divorce.

One in five women falls into poverty because of divorce. Three out of four divorced mothers don’t receive full payment of child support. About one out of every three women who own a home and have children at home lose the house after a divorce.

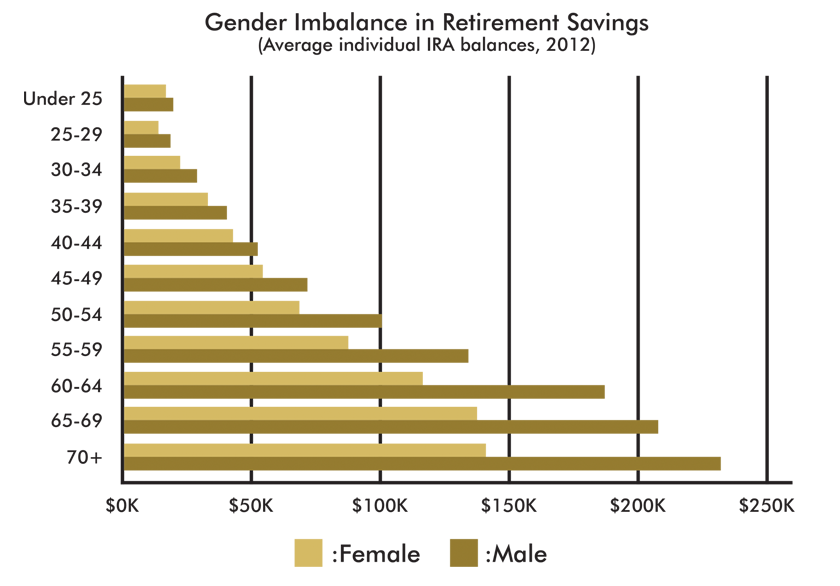

Women of all types – unmarried, divorced and widowed—from age 44 to 64 are under-prepared for retirement. IRA and 401(k) balances fall short compared to male equivalents. Single and married women tend to focus on priorities other than retirement, like paying for their children’s needs and owning a house.

One of the worst outcomes of not prioritizing savings is missing opportunities to leverage time in your favor. Money kept in interest-bearing accounts for years can grow into a substantial asset. Employee-offered accounts include tax advantages and sometimes match plans that double savings.

The wage earning gap also limits available Social Security benefits—a built-in foundation that some senior citizens rely on for retirement expenses. As a result of these trends, fewer resources and a lack of planning, women are more likely to encounter poverty in old age and forced to rely on government programs for living expenses.

Due to pay disparity, unpaid family caregiving, greater longevity, and reduced retirement benefits, the average middle-class woman is at greater risk in retirement than men—and they’re aware of it.

40% of women plan to retire after 65 and 13% say they will never retire at all.

50% of women plan to work in retirement—11% full-time and 39% part-time.

More than 41 percent of the female population struggles financially, according to Wider Opportunities for Women, a nonprofit group dedicated to female empowerment. A slowly recovering economy and persistent wage gap makes it imperative for women to increase their financial knowledge.

Today women have a higher likelihood than men of completing college and graduate school. Unfortunately graduation doesn’t guarantee financial stability. Student loans follow many graduates well into careers, and women face serious obstacles when it comes to debt repayment.

On average, woman are paid less, making an average of 77 cents compared to every dollar made by men.

While more single women are becoming homeowners, the long-term burden of paying a mortgage is no easy task. In the 1990s, single women began outpacing single men in home ownership. They outnumber men in the categories of first-time home buyers, repeat home buyers, living alone, owning a home, and in spending half their income on housing, according to the National Association of Realtors. Twice as many millennial women compared to men plan to own homes.

If you’re spending 15 to 30 years paying a high-interest mortgage, it can make putting aside cash for emergencies and retirement savings difficult.

Women are often paying higher interest rates on mortgages than men — an average of 0.4 percent, according to a 2011 study by the Journal of Real Estate Finance and Economics.

In our experience your younique financial needs include balancing your personal needs with your family responsibilities. You balance your own goals with providing for your children or caring for another family member. You work full-time, at work, and then at home. It is important to set realistic expectations, prepare for emergencies, prepare for your own independence, yet still provide for the children or another family member.

The “Do” is what turns the goal into a reality. We would love to work with you to help you understand what you need to do in order to achieve your financial goals. Please Schedule your complimentary assessment.