You are a ‘servant leader’ currently serving, or previously served, in the military…we thank you! While you were in the military you were a part of an organization that provided for equal pay and benefits as men. However, when you depart the military the workforce, pay structure and benefits structure is significantly different and you will need to learn about your new environment.

In our experience your younique financial needs include preparing for retirement from the military, or for transition from the military, both of which are significant changes that require preparation. You may also be concerned with understanding your veteran benefits and understanding the short and long term impact they have on your financial needs, and goals.

The current projected percentage of U.S. Veterans who are women is 10 percent. For the most recent projections, visit VetPOP 2011.

In FY 2009, the average age of women veterans was 48 years, compared to 63 years for their male counterparts.

The U.S. Small Business Administration (SBA) recognizes the impact that veterans have on the American economy. According to the most recent data, there is about one veteran-owned firm for every ten veterans, and veteran-owned firms employ 5.8 million individuals. A recent SBA study also found that military service exhibits one of the largest marginal effects on self-employment, and veterans are 45% more likely to be self-employed than non-veterans.

Over 725,000 female veterans have served in the Armed Forces since September 2001. The average unemployment rate over the past 12 months for female post-9/11 veterans (6.7 percent) is higher than for male post-9/11 veterans (5.9 percent). It is also higher than the average unemployment rate for women who are not veterans (5.1 percent). While male veterans’ employment is more evenly distributed across industries, over 70 percent of female post-9/11 veterans work in one of four major sectors: government, education and health, professional and business services, and retail trade.

Homelessness among women veterans is expected to rise as increasing numbers of women in the military reintegrate into their communities as veterans. The number of homeless women veterans has doubled from 1,380 in FY 2006 to 3,328 in FY 2010. While data systems for the U.S. Department of Veterans Affairs (VA) and the U.S. Department of Housing and Urban Development (HUD) do not collect data on the risk factors contributing to female veteran homelessness, women veterans face younique challenges that increase their susceptibility to homelessness.

Homeless women veterans also face substantial barriers to employment. One of the key factors for this larger percentage could be the lack of accessible and affordable child care. In fact, according to the recent FY 2010 CHALENG report, the VA and community providers ranked child care as the highest unmet need of homeless veterans from FY 2008- 2010.

We our proud to announce a partnership with In Her Boots, a program that creates a dialog between Senior and Junior female Service Members that Educates, Empowers, & Inspires targeting increased readiness, retention, and sexual assault prevention strategies.

We our proud to announce a partnership with In Her Boots, a program that creates a dialog between Senior and Junior female Service Members that Educates, Empowers, & Inspires targeting increased readiness, retention, and sexual assault prevention strategies.

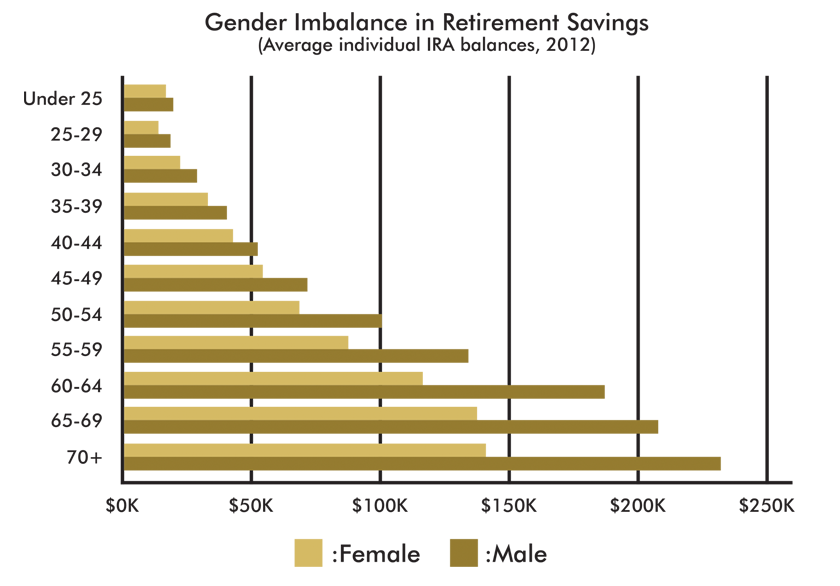

More than 41 percent of the female population struggles financially, according to Wider Opportunities for Women, a nonprofit group dedicated to female empowerment. A slowly recovering economy and persistent wage gap makes it imperative for women to increase their financial knowledge.

Today women have a higher likelihood than men of completing college and graduate school. Unfortunately graduation doesn’t guarantee financial stability. Student loans follow many graduates well into careers, and women face serious obstacles when it comes to debt repayment.

On average, woman are paid less, making an average of 77 cents compared to every dollar made by men.

The “Do” is what turns the goal into a reality. We would love to work with you to help you understand what you need to do in order to achieve your financial goals. Please Schedule your complimentary assessment.