You are an ‘independent’ woman who has pride in your freedom. You may be young (millennial) or older. Some woman choose to never marry, some haven’t made the leap or just haven’t found the right partner.

In our experience your younique financial needs include preparing and committing to a spending plan, protecting against job loss (you don’t have a partner as a back-up plan), building assets to prepare for marriage (if that is your goal), or building assets to prepare for retirement/financial independence.

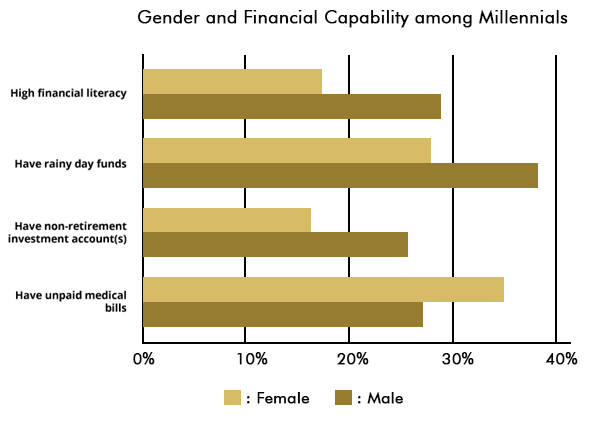

More than 41 percent of the female population struggles financially, according to Wider Opportunities for Women, a nonprofit group dedicated to female empowerment. A slowly recovering economy and persistent wage gap makes it imperative for women to increase their financial knowledge.

Today women have a higher likelihood than men of completing college and graduate school. Unfortunately graduation doesn’t guarantee financial stability. Student loans follow many graduates well into careers, and women face serious obstacles when it comes to debt repayment.

On average, woman are paid less, making an average of 77 cents compared to every dollar made by men.

While more single women are becoming homeowners, the long-term burden of paying a mortgage is no easy task. In the 1990s, single women began outpacing single men in home ownership. They outnumber men in the categories of first-time home buyers, repeat home buyers, living alone, owning a home, and in spending half their income on housing, according to the National Association of Realtors. Twice as many millennial women compared to men plan to own homes. If you’re spending 15 to 30 years paying a high-interest mortgage, it can make putting aside cash for emergencies and retirement savings difficult.

Women are often paying higher interest rates on mortgages than men — an average of 0.4 percent, according to a 2011 study by the Journal of Real Estate Finance and Economics.

Women of all types – unmarried, divorced and widowed – from age 44 to 64 are under-prepared for retirement. IRA and 401(k) balances fall short compared to male equivalents. Single and married women tend to focus on priorities other than retirement, like paying for their children’s needs and owning a house.

One of the worst outcomes of not prioritizing savings is missing opportunities to leverage time in your favor. Money kept in interest-bearing accounts for years can grow into a substantial asset. Employee-offered accounts include tax advantages and sometimes match plans that double savings.

The wage earning gap also limits available Social Security benefits—a built-in foundation that some senior citizens rely on for retirement expenses. As a result of these trends, fewer resources and a lack of planning, women are more likely to encounter poverty in old age and forced to rely on government programs for living expenses.

The “Do” is what turns the goal into a reality. We would love to work with you to help you understand what you need to do in order to achieve your financial goals. Please Schedule your complimentary assessment.