Widowhood is one of life’s tragedies. However, for most married women, it is inevitable.You are strong, and you may be young or old, either way, your strength is being tested. Widowhood is defined as the status of an individual who was legally married to someone who subsequently died.

In our experience your younique financial needs include understanding how the loss of your spouse with impact you economically. The death of a spouse will result in loss of income and property that the deceased spouse received or owned, unless provision for their continuation and inheritance is made explicit in income program rules, laws of inheritance, or through the deceased spouse’s will. For this reason, it is important to understand how marriage and inheritance rights to income and assets are defined in law and by programs that provide income.

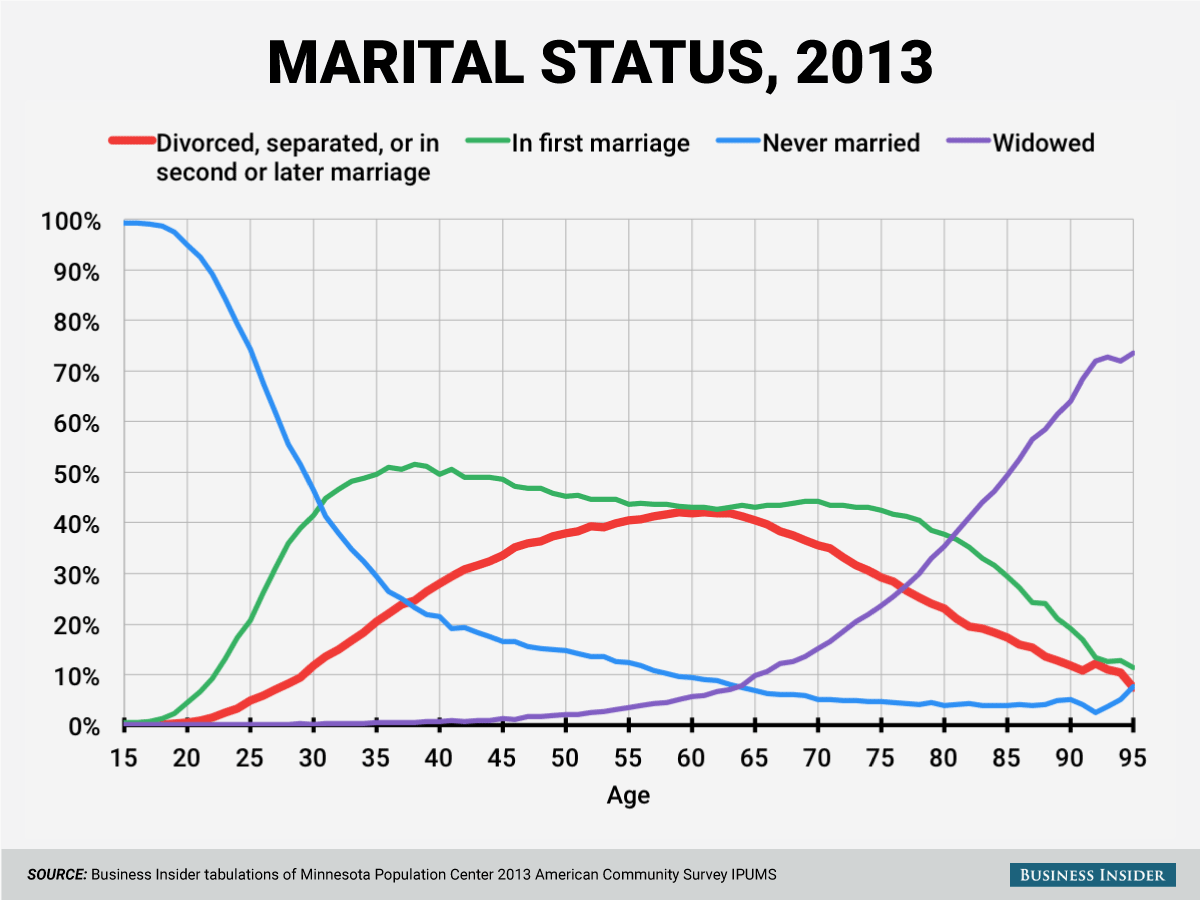

It’s a life situation that can affect even those who appear to be safe. Iit happened to Katie Couric, CBS “Evening News” host and former “Today” show co-anchor. When Katie became a widow at the age of 41 in 1998, she also became part of those dreaded statistics; a third of women who become widowed are younger than age 60, and half of all women who will become widowed become so by age 65.

On average, married women in the United States experience a decline in income when their husbands die. Although widowers (men whose wives have died) are somewhat more likely to be poor than are married couples, data that follow couples over time do not show a decline in average economic well-being for men when wives die.

Widowed older women, on average, report lower incomes and are more likely to be poor than are other groups of elderly persons. This is true in the United States and in other countries as well, though the difference in the United States is greater overall than in other developed countries. In the United States, over 48 percent of the poor elderly are widows, even though widowed women account for only 26 percent of all persons age sixty-five and older.

According to the U.S. Census Bureau 800,000 people are widowed each year in the United States. “Nearly 700,000 women lose their husbands each year and will be widows for an average of 14 year.

Death of a spouse is ranked as the #1 Stressor: Holmes and Rahe stress scale. Losing a spouse is ranked number one on the stress index scale; making this one of life’s most devastating events. The stress chart assigns a numerical point value to each life stressor. Death of a spouse scores 100 points. Oftentimes there is a snowball effect of stressors that occur as a result of the loss. With knowledge and proper care, we can prevent or lesson this statistic: 60% of those who lose a spouse or significant other will experience a serious illness in the 12 months following that loss. Those widowed have reported illnesses like cancer, pancreas’ shutting down, shingles….Widows and the friends and family that love them need to be aware of the snowball effect of such a staggering loss. We encourage you to take care of yourself!

70 percent of U.S. households with children under 18 would have trouble meeting everyday living expenses within a few months if a primary wage earner were to die today. 4 in 10 households with children under 18 say they would immediately have trouble meeting everyday living expenses. Source: LIMRA Household Trends in U.S. Life Insurance Ownership, 2010

Almost half the women over 65 years of age in the United States are widows. About 7 in 10 of these women live alone.

(U.S. Census, 2000) In recent years the average American woman’s expected lifespan has increased to eighty or more. However, the societal systems in place for caring for the elderly have not changed at the same rapid pace leaving many widows in poverty.

One Social Security Administration report shows that “for the past thirty or more years the rate of poverty among elderly widows is consistently three to four times higher than elderly married women.” (SSA, 2005) These statistics do not take into account the population of widows under the age of 65 or those raising families.